NatSatTel 2025 — Hot Topics of the Global Satellite Industry

24.06.2025

In April 2025, Intersputnik, in partnership with the Satellite Markets and Research analytical agency, organised the NatSatTel 2025 annual international online conference on Key Trends and Opportunities in the Global Satellite Industry. This year, the geography of registered attendees of the event has significantly expanded – it was attended by more than 170 representatives from 47 countries of Central and Southeast Asia, Latin America, Africa, the Middle East, Europe and the Caspian region. NatSatTel 2025 was moderated by Virgil Labrador, Editor-in-Chief of Satellite Markets and Research. (Download this Detailed Review in .pdf)

In her welcoming speech, Intersputnik’s Director General Ksenia Drozdova emphasised the importance of the conference for the satellite communications industry, which was attended by operators, leading analytical agencies, technology experts, as well as representatives of national and international regulators. Separately, Ms. Drozdova mentioned Intersputnik’s active cooperation with the International Telecommunication Union (ITU).

Key trends in the development of satellite communications and future forecasts for the space economy

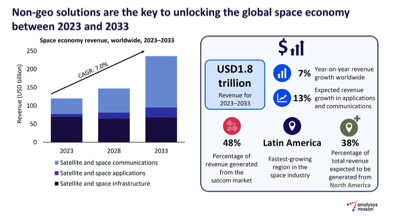

Vivek Prasad, Principal Analyst of Analysys Mason, briefed the conference attendees on key trends in the development of satellite communications. Global space economy revenues will total up to $250 billion between 2023 and 2033, with satellite communications revenues growing by 13%. Non-geostationary solutions are to become the key drivers of the global space economy, with broadband and direct-to-device (D2D) connectivity being the fastest growing applications.

Technologies that facilitate the development of satellite communications include low-cost terminals, inter-satellite communication channels and increased bandwidth. As forecasts say, the global space economy can reach approximately $1.8 trillion between 2023 and 2033, with a compound annual growth rate (CAGR) of 7%. And the satellite communications market will be a major source of revenue, accounting for 48% of the total volume (Fig. 1).

Speaking of regional markets, the largest one is North America. It accounts for 38% of total revenue. Accelerated growth is being seen in emerging market economies, such as Latin America, Africa and Asia. According to Analysys Mason, Latin America will become one of the fastest growing regions of the global space economy in the coming years. The broadband and direct-to-device connectivity segments will develop most actively in North America and Latin America.

Satellite communications market revenue structure

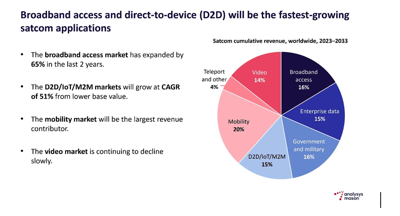

Video remains one of the largest sources of revenue, but its share is gradually declining by 3-5% per year. Its contribution to total revenue will be approximately 14% (Fig. 2).

The broadband market has expanded significantly in recent years. Its share in the total revenue of the global industry is expected to be around 16%. Here, the main source of income will come from the mobile market, where customers expect quality equal to that provided in the fixed-line market. Overall, the market for government services will also see moderate growth with explosive demand for services in regions of geopolitical conflict.

Starlink: flexible pricing strategy as a factor of rapid development

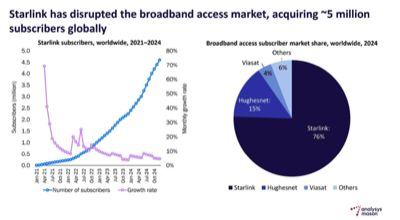

Starlink has reached the mark of five million subscribers and controls three-quarters of the satellite broadband market (Fig. 3).

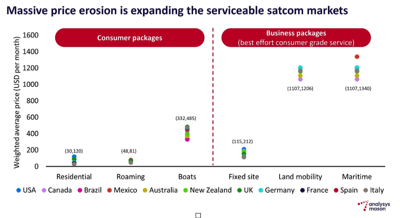

The chart below shows prices for Starlink services in several key countries, thus, the numbers in brackets are the lowest price limit (Fig. 4).

Starlink is demonstrating growth at an impressive rate due to its proper approach to pricing. In the consumer broadband market, price is the key, and Starlink has been successful in offering high-speed connections at affordable prices – connections ranging from 100 Mbps to 220 Mbps at prices lower than from conventional providers. The company adapts its tariffs depending on demand and competition in a specific region. For example, the operator began offering services in Kenya at a price of $10 per month, which became one of the factors for its market expansion. Starlink is expected to reduce prices, especially in cost-sensitive markets. And new versions of satellites equipped with inter-satellite communication systems will increase the efficiency of the constellation.

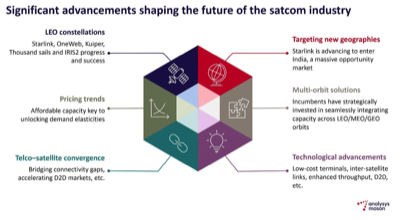

Future of the satellite communications industry

Multi-satellite constellations, such as Starlink and OneWeb, have already begun to expand their footprint and are having a major impact on the consumer broadband and mobile markets. Starlink is taking all of its first-mover advantages. But there are some new constellations capable of seriously competing it in the near future and changing the satcom market. For example, Kuiper and the Chinese Thousand Sails project. These systems have potential market advantages: Kuiper gains access to retail through Amazon and corporate business through AWS, while Thousand Sails utilise the Silk Road initiative to provide access to more than 100 countries in Africa, Latin America and Asia (Fig. 5).

Leading operators have invested heavily in multi-orbit solutions, and much in the satcom market now depends on their success. However, Mark Dickinson, Chief Technology Officer of NEO Space Group, said at the New Innovative Services for Satellite Operators session that there was no need to build one’s own LEO constellation to implement a multi-orbit strategy. By using the capabilities of various constellations on a partnership basis, it is possible to flexibly adapt to the various tasks of customers.

Development drivers of the satellite communications market

Brandon Seir, CCO, Kasific Broadband Satellites, an operator with approximately 15,000 terminals installed in the Asia-Pacific region, covering more than 500 thousand users, named three main drivers of satcom: bandwidth optimisation, artificial intelligence and multi-orbit.

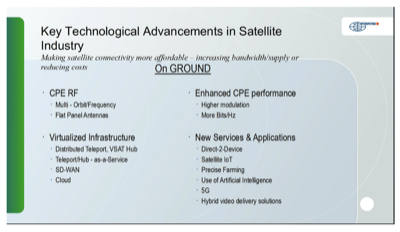

Andrey Kirillovich, Director of Strategy, Marketing and Business Development at Intersputnik, outlined in his message the main technology innovations determining changes in the satellite communications industry at present: development of multi-satellite non-geostationary constellations; reduction of launch costs; mass production of satellites; improvement of Flat Panel Antennas (FPA); commissioning of VHTS (very high throughput satellites); use of small GEO satellites; digital software-defined payload allowing, in particular, more flexible joint operation of a satellite by various users. New technologies and virtualisation methods have been driving cost reduction in the ground segment (Fig. 6).

Key aspects of the further development strategy: close cooperation and consolidation in the field of standardisation; increasing the scale of production of customer premises equipment (CPE) and reducing costs, which will result in the stop of subsidizing CPE by service providers. The multi-orbit strategy will rely on several players in the low-orbit market. Next-generation geostationary high and very high throughput (GEO HTS/VHTS) satellites will be able to support the majority of business cases (80%-95%).

D2D market prospects

This issue was discussed by experts during the Key Technologies to Watch session. Since the topic has been hot for the last year, almost all speakers expressed their opinions on the development of the D2D technology.

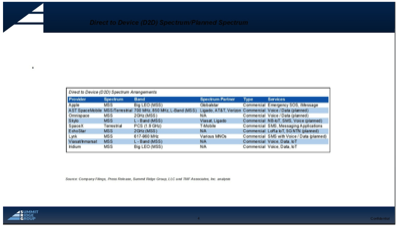

Spectrum is everything

Summit Ridge Group is currently clearing spectrum for one of the D2D players, so Armand Musey, its President and Founder, focused his speech on spectrum issues. He noted that as the operator moves to lower frequencies — more resistant to weather conditions, allowing the signal to propagate in the forest, that are more beneficial for D2D — the available spectrum is reducing. The problem is exacerbated by two aspects: first, the industry is moving toward applications that require ever greater bandwidth; second, D2D systems require frequency coordination on a global or quasi-global scale.

Armand Musey presented a list of D2D operators and the spectrum available to them (Fig. 7). Using terrestrial cellular networks frequencies is a very expensive option. So, these operators will seek to use other parts of the spectrum, but this resource, as mentioned above, is very limited. In the D2D market, winners and losers can be sorted by the availability of suitable spectrum, and Globalstar looks the most favourable here.

The next obstacle to the development of this technology is the division of markets. 70% of the world are covered by water, which greatly worsens the economics of global LEO systems. Then, for one reason or another, operators exclude, for example, the Chinese market, which again reduces profitability. Moreover, there are talks on separating the European and US markets, and the economics gets very tough.

In addition, the profitable part, namely in the form of incoming funds, is questionable. For many iPhone users, the ability to send an emergency signal through Globalstar is a reason to choose iPhone. For Apple, this is an opportunity to sell more iPhones. But it is unlikely that the same people will pay extra money for such services. This is where the serious conversation about real commerce begins.

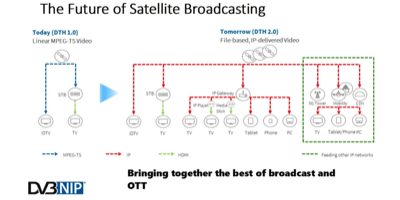

Current standards for satellite video distribution

Thomas Wrede, Managing Director of Technology Vision Consulting, spent almost thirty years at SES, a satellite operator has been building its business on video distribution and television broadcasting. At the conference, he spoke on behalf of the DVB Project consortium, where he heads the commercial module of the satellite group.

Thomas Wrede stated that the satellite video distribution industry would exist and play a significant role for quite a long time. Although this sector is shrinking by 6-9% every year, this trend is unlikely to intensify. Satellite broadcasting remains a technology that allows covering large areas at minimal cost. It remains a profitable business for satellite operators, providing the means to implement multi-orbit strategies, create data networks, etc.

DVB-I

New standards being developed within the DVB consortium optimise video distribution services to meet the modern requirements of viewers and broadcasters.

DVB-I is a standard, a mechanism for transmitting signals in any environment — over IP networks or broadcast networks. It is not a new physical layer standard. It allows broadcasters to implement content delivery to any user device on a single platform without using a wide number of various applications. DVB-I allows end users to avoid thinking about the path and medium through which content reaches them. DVB-I provides a single, consistent user interface for all types of content, whether live and linear TV, on-demand TV, set-top boxes and even interactive applications (Fig. 8).

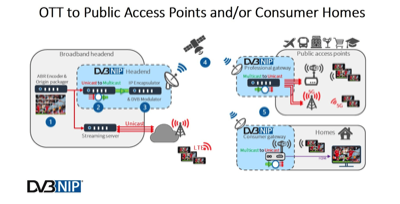

DVB-NIP

DVB Native IP (DVB-NIP) enables the benefits of broadcast networks to distribute content to modern IP devices. Operators can use a broadcast signal (e.g. from a satellite) to transmit content to, for example, cell towers or access points, and to transmit the signal to IP-enabled TVs, as well as broadcast to IP devices (Fig. 9).

Regional development, ITU initiatives and preparations for the World Telecommunication Development Conference (WTDC-25)

The round table, organised by ITU and Intersputnik as part of NatSatTel, was focused on connecting the unconnected and developing digital satellite infrastructure in the regions of Central Asia and the Caspian Sea. The choice of the region for the round table discussion was associated with the upcoming World Telecommunication Development Conference 2025 (WTDC-25), which will be held on 17–28 November 2025 in Azerbaijan. Daria Korsu, a representative of the ITU Regional Office for the CIS, told the conferees about the preparations for this significant event in the global telecom industry, about the 160th anniversary of ITU, which is celebrated in 2025, as well as about the most important ITU programmes, including the Girls in ICT initiative.

ITU plays a key role in the development of telecommunications, manages the radio frequency spectrum at global scale, including frequencies used in space, and ensures the coordination of satellite systems. The first ITU space conference was held in 1963 after the launch of the first communications satellites. Now, at a time when orbital space is becoming crowded, ITU continues to play an important role in managing radio frequencies and providing access to satellite communications systems.

The World Telecommunication Development Conference (WTDC) is the flagship event of the ITU-Development sector. It sets strategies and goals for the development of information and communication technologies (ICT). The conference considers the development of telecommunications at the global, regional and national levels.

The round table was moderated by Natalia Vicente, VP Public Affairs of the Global Satellite Operators Association (GSOA), and Andrey Kirillovich, Director of Strategy, Marketing and Business Development at Intersputnik. A representative of GSOA, the largest international industry organisation uniting satellite communications market players, drew attention to the important role of satellites in programmes aimed at reducing the digital divide, and a representative of Intersputnik emphasised the need for international cooperation.

GSOA unites the majority of commercial players in the satellite industry from across the vertical industry chain and advocates for the use of satellites to achieve the UN Sustainable Development Goals, connect the unconnected, and bridge digital divides of all kinds. In preparation for WTDC-25, the association is working with regulators to explain the benefits of satellite technology.

At the roundtable, speakers from national regulators of Azerbaijan, Kazakhstan and Uzbekistan discussed the important role of satellite systems in connecting the unconnected across the region. Sahiba Hasanova, Ministry of Digital Development and Transport of the Republic of Azerbaijan, Agzam Tajibayev, Ministry of Digital Development, Innovation, and Aerospace Industry of the Republic of Kazakhstan, and Sirojiddin Usmanov, Ministry of Digital Technologies of the Republic of Uzbekistan, spoke about satellite communications and broadcasting projects, the role played by satellite technologies in connecting all residents of their countries, government programmes for affordable Internet, and new opportunities for non-geostationary systems.

Future trends of the satcom market

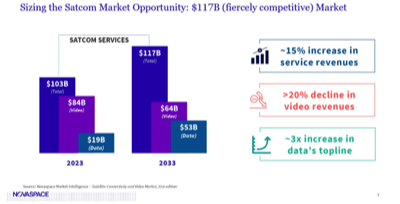

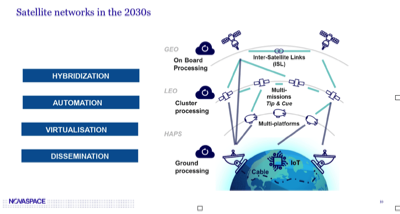

The final keynote presentation of the conference was an analytical review by Jean-Baptiste Thepaut, Principal-Satcom, Novaspace, where he presented in detail an assessment of the possibilities of the satellite communications market and its further changes. Video revenues will fall by 20%, while revenues from data transmission will triple. He also noted the prospects for direct-to-device services. Among market trends, Thepaut mentioned the continuation of mergers and acquisitions expected in the next 2-3 years. The key trends in the development of satellite networks in the 2030s will be hybridisation, automation and virtualisation.

In 2016, broadcasting activities of conventional satellite operators began to experience the first signs of decline. Operators began to tap into broadband connectivity markets and launched high-capacity systems, such as Intelsat EPIC and Inmarsat Global Express.

The advent of Starlink has profoundly changed the satellite communications industry. Consumer demand has changed dramatically, and satellite Internet access standards have grown significantly. Designers and manufacturers began to produce flat panel antennas. Competition has intensified, and the entire value chain has adapted to new market conditions.

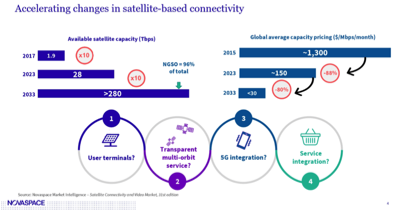

The most important development trend is the growth in the number of satellite constellations, which will lead to increased competition and significant changes in satellite services. Software-defined payloads, ground segment virtualisation, and integration of satellites with cloud services will also be factors promoting the growth of demand. The supply of satellite capacity will increase tenfold over the next 10 years (Fig. 10).

The increase in supply will trigger a reduction in prices to the level of terrestrial networks, which, in turn, will stimulate an increase in demand. This will result in another trend — the development of hybrid networks that combine the capabilities of all types of orbits — low, medium, and geostationary. New services — Direct-to-Device (D2D) and IoT — have been increasing demand for satellites.

The increase in demand offsets a significant reduction in prices. Although video streaming revenue will fall from $84 billion in 2023 to $64 billion in 2033, due to data revenue growth from $19 billion to $53 billion, total satcom revenue will increase from $103 billion to $117 billion (Fig. 11).

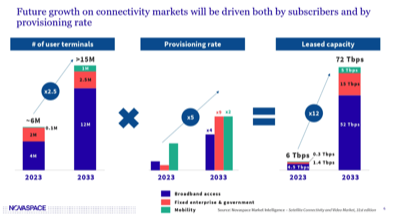

According to Novaspace forecasts, the number of satellite communications users will increase by approximately 2.5 times over the next decade (Fig. 12).

The number of terminals is growing, but the biggest contribution to the increase in demand will not be their number, but an increase in throughput per terminal — fivefold over the next 10 years.

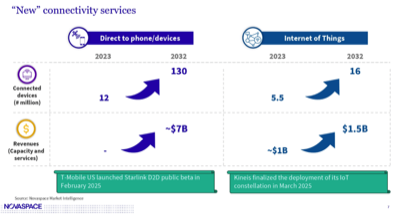

The introduction of new services, such as D2D and IoT, will be driven by the same need for ubiquitous and reliable coverage, as well as similar dynamics of hybrid networks combining satellites with terrestrial systems (Fig. 13).

Over the next few years, several constellations specifically designed to provide IoT services will be put into operation. This sector is driven by low-power, low-cost innovations tailored to specific IoT cases. The emphasis is on efficiency (compared to high throughput applications) Satellite IoT technologies are becoming more and more cost-effective, which will contribute to their expansion in the coming years. The number of connected devices is projected to roughly triple over the next decade, reaching 16 million in 2032. Revenues will increase by only 50%, reaching $1.5 billion.

There is a lot of enthusiasm for D2D services, but it is difficult to predict the development of this sector due to uncertainty regarding the actual performance of the service, its prices, and the willingness of potential subscribers to pay for it. At the same time, Novaspace expects the market to grow much faster than the IoT market, with the total number of connected D2D devices reaching 130 million in 2032 (up from 12 million today), and revenue of around $7 billion (experts considered today's level to be “almost zero”).

Similar to the experts who have spoken out earlier, Jean-Baptiste Thepaut believes that the issue of spectrum is essential. Starlink, Link and AST SpaceMobile can only operate in partnership with MNOs using their frequencies. This is where the main competitive battle will take place: D2D operators will strive to make deals with mobile operators before their competitors. And for players like Globalstar and Inmarsat, which have their own spectrum, the key to success will be convincing chipset and handset makers to integrate their frequencies and ensure hardware compatibility with unmodified phones.

he consolidation trend that began several years ago is not abating. Increased competition has led to vertical and horizontal integration, and more merger and acquisition activity and partnerships between satellite operators can be expected in the future. LEO infrastructure requires significant capital investment, often far exceeding the capabilities of regional and even global operators. In turn, operators of geostationary constellations, in order to remain in demand on the market, will be ready to merge or enter into other forms of strategic partnership.

Among the prospects that should be noted is the hybridisation of services. Moreover, we are talking not only about constellations in different orbits, but also about the inclusion of high-altitude platforms in the ecosystem. This will require the widespread implementation of high-speed inter-satellite communications. Satellites are becoming increasingly intelligent due to the growing capabilities of control processors and the development of cluster processing capabilities in multi-satellite constellations. Growing virtualisation of terrestrial segment capabilities facilitates the transition to fully integrated delivery of end-to-end cloud services and integration with 5G networks (Fig. 14).

NatSatTel 2025 dealt with and discussed all issues that are relevant to satcom today; the conference once again proved to be one of the leading events for experts in satellite communications and digital infocommunication ecosystems.